The Hagerty Bull Market List is an annual compilation of classic and modern-classic cars which provide the owner with a pleasurable driving experience while also predicting which makes and models could be bought without fear of them losing money.

However, the list isn’t tailored to investors, it’s aimed at people who want to find, buy and drive a vehicle they love. The standout advice from Hagerty experts is to buy any classic car with your heart as they are built to be enjoyed and driven as often as possible. Buy a car you like first and foremost, and should it deliver a healthy return financially, consider that an added bonus.

To compile the report, Hagerty analysed both its market valuation data and insurance quotes and policies, looking for indicators that suggest a car is rising in value and increasingly in demand among drivers. The UK Hagerty Price Guide also tracks auction sale results and private sales to ensure drivers can be fully informed about the value of a classic or modern-classic car.

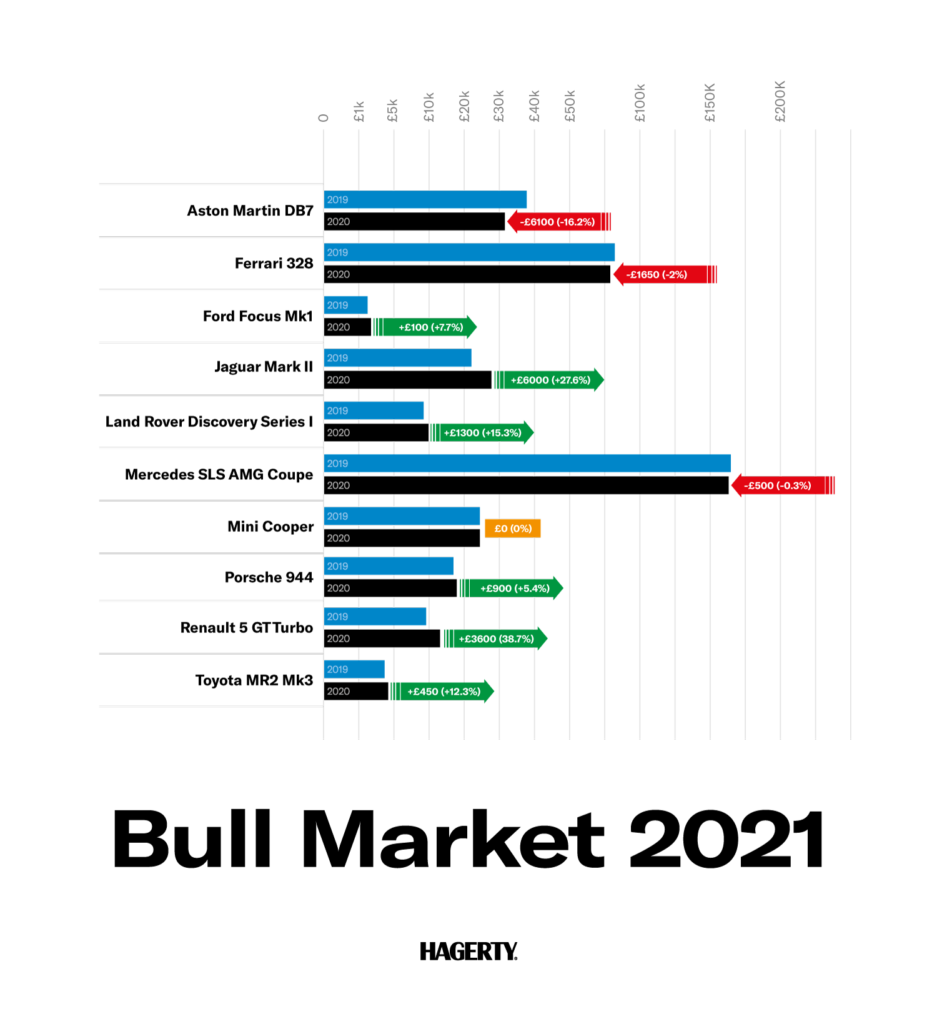

One fundamental difference of the Hagerty Bull Market is that Hagerty experts look back at the previous year’s selection and compare the cars’ predicted values with the actual values a year later. Previously, in the US, the humble Toyota MR2 – one of the most affordable cars identified – was the strongest performer, rising in value by an average of 30 per cent. From the 2018 list, it was the BMW M3, which recorded an average rise of 20 per cent.

For the inaugural 2021 Hagerty UK Bull Market List, the selection of cars highlighted by Hagerty is wide and diverse, meaning there should be a car to suit most tastes. The 10 smart-buy classic cars are:

Aston Martin DB7

The average Hagerty Price Guide ‘excellent’ value across the DB7 range has dropped from £37,680 in 2019 to £31,580 today. But it’s an Aston Martin and will surely bounce back. As the cars’ age and miles creep up, well-preserved examples should become more sought-after, now may well be the time to buy while prices are low.

Ferrari 328

Ferrari 328 values shot up in the first half of the 2010 but since then it has dropped annually as the appetite for modern-classic Ferraris subsided. From 2016 to 2019, values fell at roughly 11% per annum, but last year this reduced to just 2%. It has all the markers of a successful classic: a legendary manufacturer, rarity and an 80s look that is so attractive.

Ford Focus (Mk1)

Hagerty has long championed the unexceptional saloons, estates and hatchbacks that take us to our offices, drop our kids at school and transport us on holiday. Values for the Focus are low: even an ‘excellent’ example can be purchased for around the £1,400-mark, fair ones for much less. We believe that this is a very small outlay for a piece of automotive history that drives as good as it looks.

Jaguar Mark II

The Jaguar Mk II is an iconic classic which has been collected and cherished since the day it was first sold. In recent years, prices have been relatively steady, however, values have already risen by nearly a third this year. We feel that the Mark II Jaguar still has potential for growth and now may be the time to buy.

Land Rover Discovery (Series 1)

Values of classic Range Rovers have rocketed over the last five years, and we believe it’s about time the Series I Land Rover Discovery followed suit. Until recently, even the best could be bought for a few thousand, but in recent months, exceptional examples have achieved much more: in June, CCA sold one for £12,320.

Mercedes-Benz SLS AMG

As with most modern performance cars, values tend to dip at first and until very recently advertised prices were dropping each month compared with 12 months previously. From September 2020, asking prices rose: the convertible by 2.3% and the coupe by 2.5%. As Mercedes gears up for the era of electrification, the SLS could be a high-tide mark from the petrol era.

Mini Cooper

Values of all variants of the Mk 1 Austin/Morris Mini Cooper have been increasing in value over the last few years, but Hagerty believes they have the potential to rise again in 2021, thanks to the 60th birthday. The first 997cc model also seems somewhat undervalued, given the prices asked for its later, larger-engined brethren.

Porsche 944 S2

The 944 is still available for just a few thousand pounds. Our pick of the bunch is the naturally aspirated S2. More drivable than the Turbo but with just 10hp less, the 3-litre S2 briefly shot up in value in 2016, and after a quick correction has been gaining steadily in value ever since.

Best examples of the 944 S2 now sell for in excess of our top Hagerty Price Guide figure: always a sure sign values are moving.

Renault 5 GT Turbo

Hot hatches are THE modern classic cars of the moment and values of popular models have soared, but one is still obtainable and it’s more powerful than them all. With 115bhp on tap the Renault 5 GT Turbo has a current value of £12,900 and still looks as if it has significant potential to climb.

Toyota MR2 (Mk3)

How long can a car like the Toyota MR2 remain a secret? Even a rare unmolested example will only set you back a few thousand pounds. It has Toyota’s robust mechanicals and leather or Alcantara options make the interior not a bad place too. With our HPG ‘excellent’ value at just £4,100 the roadster from Japan seems undervalued.

John Mayhead, Head of Hagerty UK Valuations, said “The Hagerty valuation team tracks many thousands of cars every year, but these really stood out. It’s a wonderfully diverse list that offers cars that are accessibly to many enthusiasts. Although changes in the value of a classic car may be far from an enthusiast’s mind, these cars may offer the chance for some of their ownership costs to be offset if they rise in value as predicted.”

James Mills, Hagerty’s UK Editor, added “There are many wonderful enthusiast cars to choose from, but the truth is nobody wants to buy a car that’s going to lose them a small fortune. The Hagerty Bull Market list identifies 10 great classics and modern-classic cars that appeal to all tastes and budgets – cars that will genuinely spread a smile across anyone’s face – but as a sweetener, we predict they shouldn’t lose money. We’ll be back next year to review the performance of our chosen cars, and present another Bull Market list.”